How a negative income tax could both be pro-business and pro-welfare in the UK?

How a negative income tax could both be pro-business and pro-welfare in the UK?

Tax reform and a universal basic income are both topics that

have garnered more and more interest in recent times. President Trump’s controversial budget

has major changes to the US tax

code. Whilst his Democratic opponent, Hillary Clinton even suggested that

she would ran on a platform offering a universal

basic income. One proposed policy position which would combine ideas from

both these political foes, is the negative income tax.

A negative income tax was first proposed by a female British

politician Juliet

Rhys-Williams, as an alternative to the famed Beveridge

Report and as a way to deal with the crippling poverty and social issues

the United Kingdom faced after World War 2. But

it was later popularized by the neoliberal economist Milton Friedman. In 1969

President Richard Nixon was close to passing a form of negative income tax, in a

continuation of his predecessor -Lyndon B. Johnson’s infamous war

on poverty. Nixon later changed his mind and his ambitious new policy to

take on poverty was later dropped.

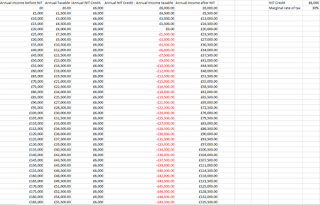

I am going to show you how a negative income tax would work with

a flat rate of income tax at 30% and a single income tax credit of £6000.

Whether an individual would earn a supplementary income or be a taxpayer depends on the difference between the income tax credit of £6000 and their

taxable income, which would be 30% of their income in my scenario. So an

individual who is earning £15,000 pre-NIT would have a taxable income of £4500,

however when you take into account the £6000 income tax credit they would

instead be net recipients of £1500 a year along with their £15,000 income. Under

my plans an individual would only begin to be paying direct taxes when they are

on incomes above £20,000 a year or £1666.67 a month.

I support a flat rate of income tax at 30% because this

would mean a more equitable

income tax system and universal policies also tend to have a larger

amount of support from the public than means-tested/differentiated

policies. But when balanced with the £6000 Income Tax credit that everybody

would receive then the effective tax rate for those on higher incomes would be

larger than those on lower incomes. An individual who earns £30,000 a year

under my plan would have a taxable income of £9000, but once the £6000 Income

Tax credit is taken into account they would instead pay £3000 a year in Income

Tax and have an effective tax rate of 10%. An individual who earns an income of

£100,000 would have a taxable income of £30,000, but with their Income Tax

credit take into consideration they will pay £24,000 a year in Income Tax and

will have an effective tax rate of 24%. So in my Negative Income Tax plan, flat

rate of Income Tax at 30% coupled with an Income Tax credit of £6000, would

still in effect act as a Progressive tax system since those on higher incomes

would still have a larger effective tax rate, as there Income Tax Credit will tend to be far smaller compared to their taxable income and so the wealthier would still

shoulder a larger

burden.

This is slightly different to the current UK tax system

where individuals have an income tax free personal allowance of £11,500 and the income above

this amount would be subjected to differing income tax rates. Currently there

is also a very low national insurance threshold which can be reached as low as £486

a month. Also under a negative income tax there would be a single income

tax credit and you can do away with all the other deductions and benefits that

overly bloat

the system.

One of the benefits of a negative income tax is that it

offers a basic income and it gradually reduces the amount of money an

individual receives from the state and as a way to gradually increase taxation,

so as to avoid a welfare

trap. Where individuals would avoid working longer hours because they would

be hit by high marginal tax rates. Another benefit of a negative income tax is

that it would allow for HM Revenue and Customs (the UK’s tax collection

authority) and the Department for Work and Pensions (the UK’s welfare agency)

to merge and this would save money. A negative income tax could also greatly

reduce the complicated benefit system and save time it takes for low income

individuals to claim a whole collection of benefits, with the Adam Smith

institute estimating departmental savings of £6

Billion. Also with a negative income tax it may also be possible to abolish

the minimum wage, which when increased can often have perverse incentive

whereby firms may cut an individual’s

hours or lay workers off.

However I would personally recommend that the UK should also

significantly change the tax code, so that multiple

taxes are incorporated into a negative income tax, I would merge the

dividends tax, national insurance and capital gains tax into the negative

income. I would also like remove loopholes that lead to both tax avoidance. I

would also suggest that the UK should also fully remove physical

currency, so that we can crack down on tax evasion. In the UK it is

currently estimated by the IFS that 1

in 3 returns under report income, with this figure rising to 2 in 3 returns

carried out by individuals who are self-employed. Although removing

physical currency should be done in a controlled manner so as to minimise

potential harm to individuals.

I also think that in conjunction with simplifying the tax code and fully

digitising the currency the UK should carry out return free filing, as a way to

save time for individuals and businesses, as well as removing the Pay as you

Earn tax system, this is where employers deduct Income Tax deductions from your

pay before you are paid. This policy was even considered by the Conservatives

in 2010. So under my planned changes there would instead be a Pay as you Go

Income Tax system which would affect all individuals this is used in Australia

for businesses. HMRC would calculate your taxable income by calculating the

money that is paid into your account and finding 35% of that income, this is also known as return free

filing, and the difference from your taxable income and the Income Tax Credit and HMRC would then deduct money automatically or pay a supplementary income to an

individual, with the removal of physical currency HMRC would be able to make a

more accurate assessment of an individual’s income. Return free filing and a

Pay as you Go tax system could reduce the time and effort both individuals and

businesses spend on complying with tax legislation, which PWC currently says

takes around 110

hours and the AAT says that tax compliance costs £10

Billion. HMRC has currently been trialling return free filing or what has been come to be known as a simple assessment form.

A negative income tax should in my opinion be a part and

parcel of a comprehensive package to help create a more prosperous and

generally wealthier population. There are also needs to be a range of policies

that help to bring down the ever increasing cost of living. I would also like

to see a greater level of house building to take on the rising

house prices and rents that do not keep up with real incomes. This can be

encouraged through loosening

planning permission rules, loosening

the green belt, levying

a land value tax and getting

housing associations and local authorities to build larger number of houses.

The UK should also attempt to reduce the cost of energy by allowing more developments

in fracking to be made, in the United States developments in fracking have

considerably reduced

the energy prices for average consumers as well as creating more than 1

million jobs. The UK could also reduce the ‘green levies’ on energy that

can mean even with falling wholesale price of oil and gas we can see energy

prices increase.

Comments

Post a Comment